InvestEd

Mobile app for Finance education

CLIENT

Hypothetical

PROJECT DURATION

Mar '24 - Jul '24

KEY MOMENTS

PROBLEM STATEMENT

Design a product for someone (youth, well educated, well earning, early career) who has trouble planning and tracking their finances so that they become better at financial planning and have a secured financial future.

PROJECT BACKGROUND

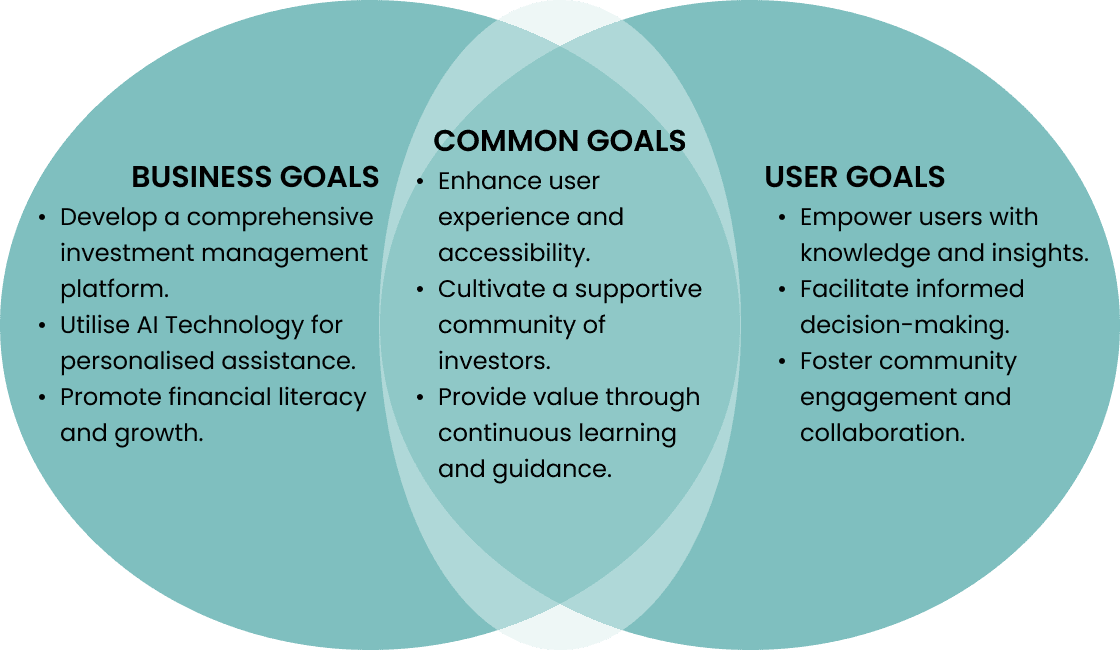

InvestEd wants to develop a finance guidance app for young adults. This project aims to provide a user-friendly platform with features such as budgeting, expense tracking, and financial education. It will focus on budgeting, investment guidance, and overall financial well-being. With this app, we seek to empower users with an engaging interface, customisable features, and educational content.

HIGH LEVEL GOALS & OBJECTIVES

The goal of the app is to empower young adults with practical tools, promoting sound financial decision-making and responsible money management within a comprehensive and engaging user experience.

OBJECTIVES

Empower young adults with a user-friendly finance management app.

Enhance budgeting skills, provide investment guidance, and promote overall financial well-being.

Foster responsible financial habits and decision-making through an engaging and educational user experience.

USER RESEARCH

RESEARCH METHOD

SECONDARY RESEARCH

I began by gathering data on financial literacy trends among young adults in India. This helped me understand the key challenges they face and the importance of financial education.

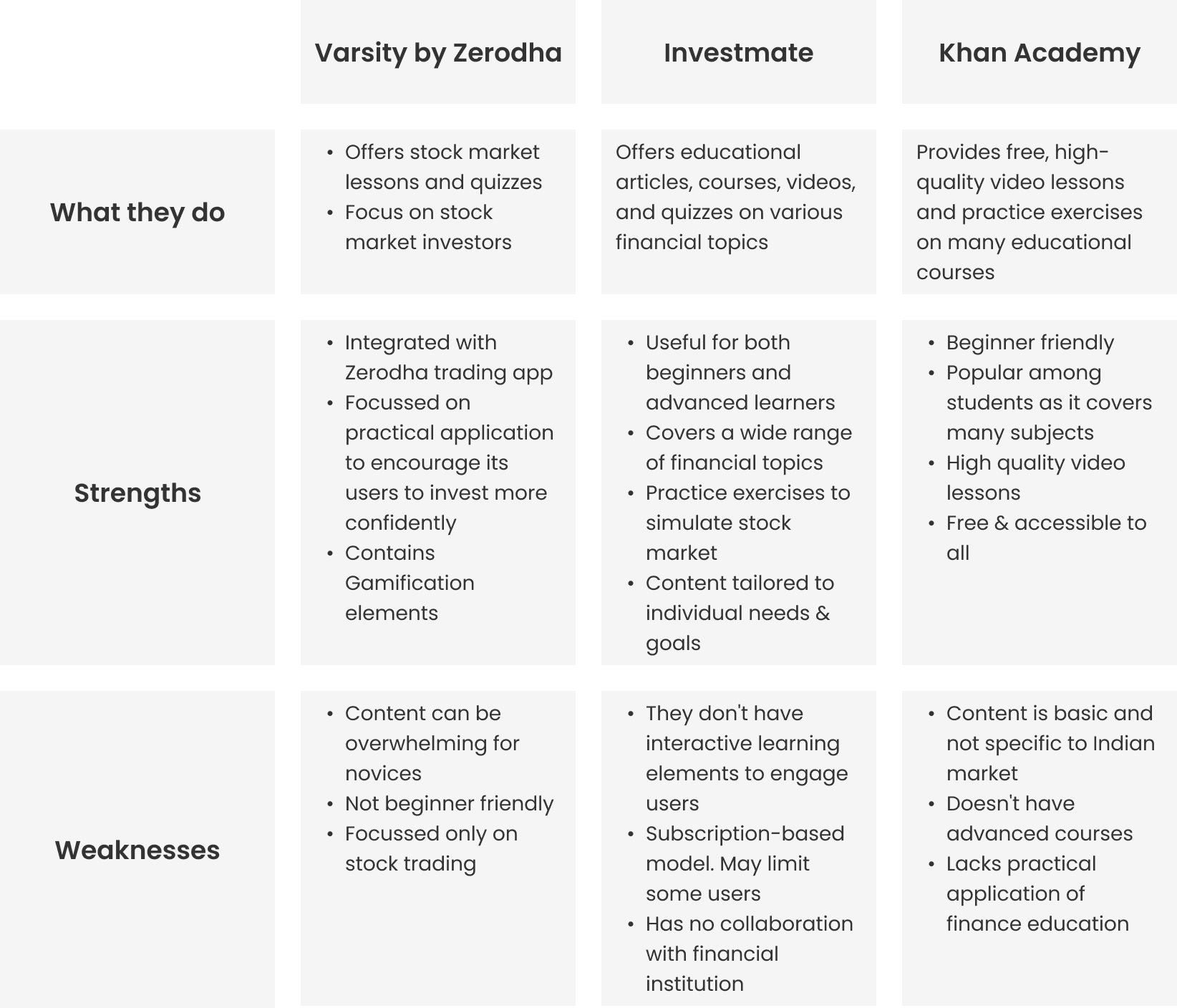

COMPETITIVE ANALYSIS

A competitive analysis was done to study existing financial apps - identify their strengths, weaknesses, and gaps in the market.

SURVEY

I conducted online surveys to collect quantitative data on users' financial habits, goals, and preferences. This step helped me identify common trends and user needs.

USER INTERVIEW

Finally, I conducted in-depth interviews with four potential users to explore their experiences and challenges with managing finances.

COMPETITIVE ANALYSIS

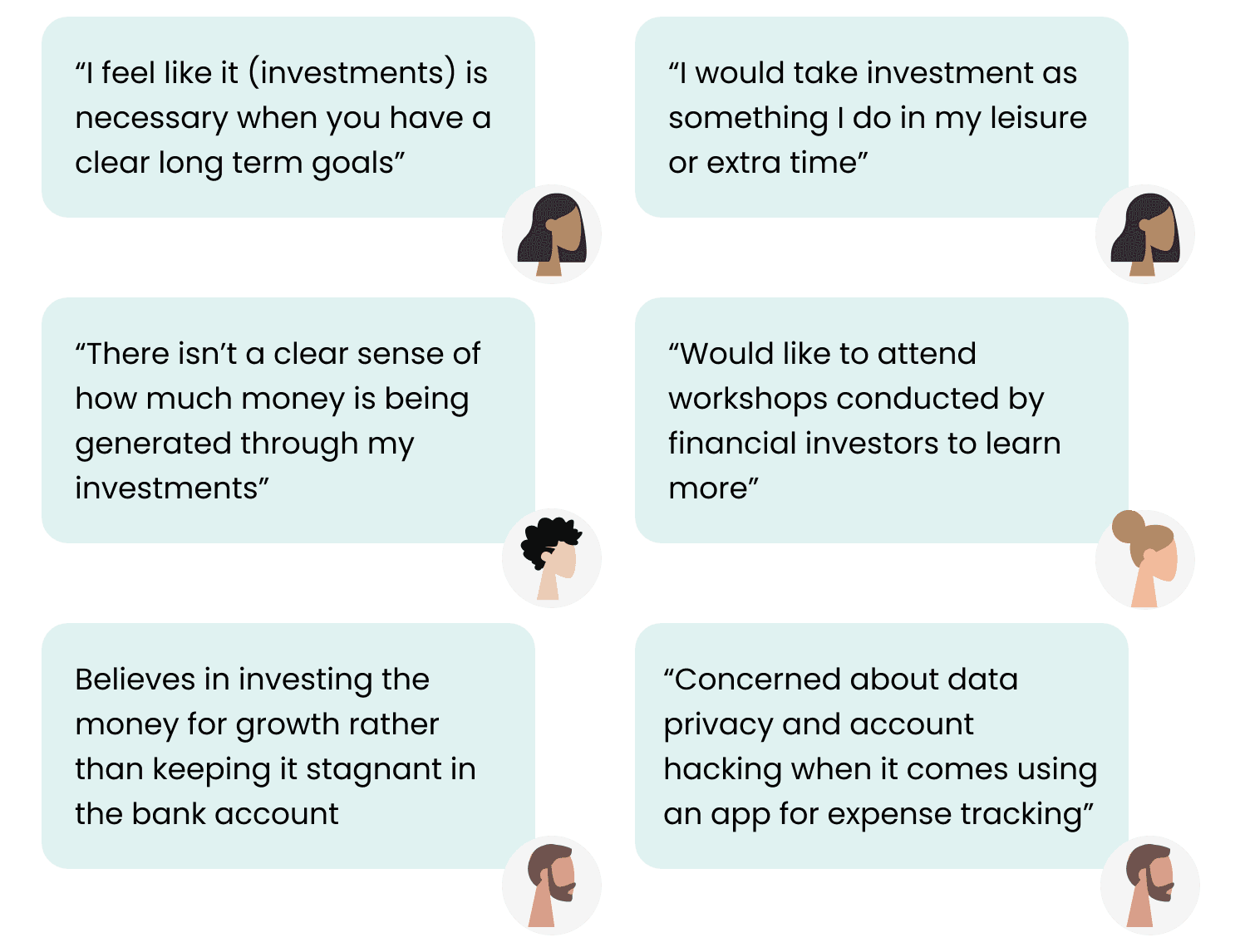

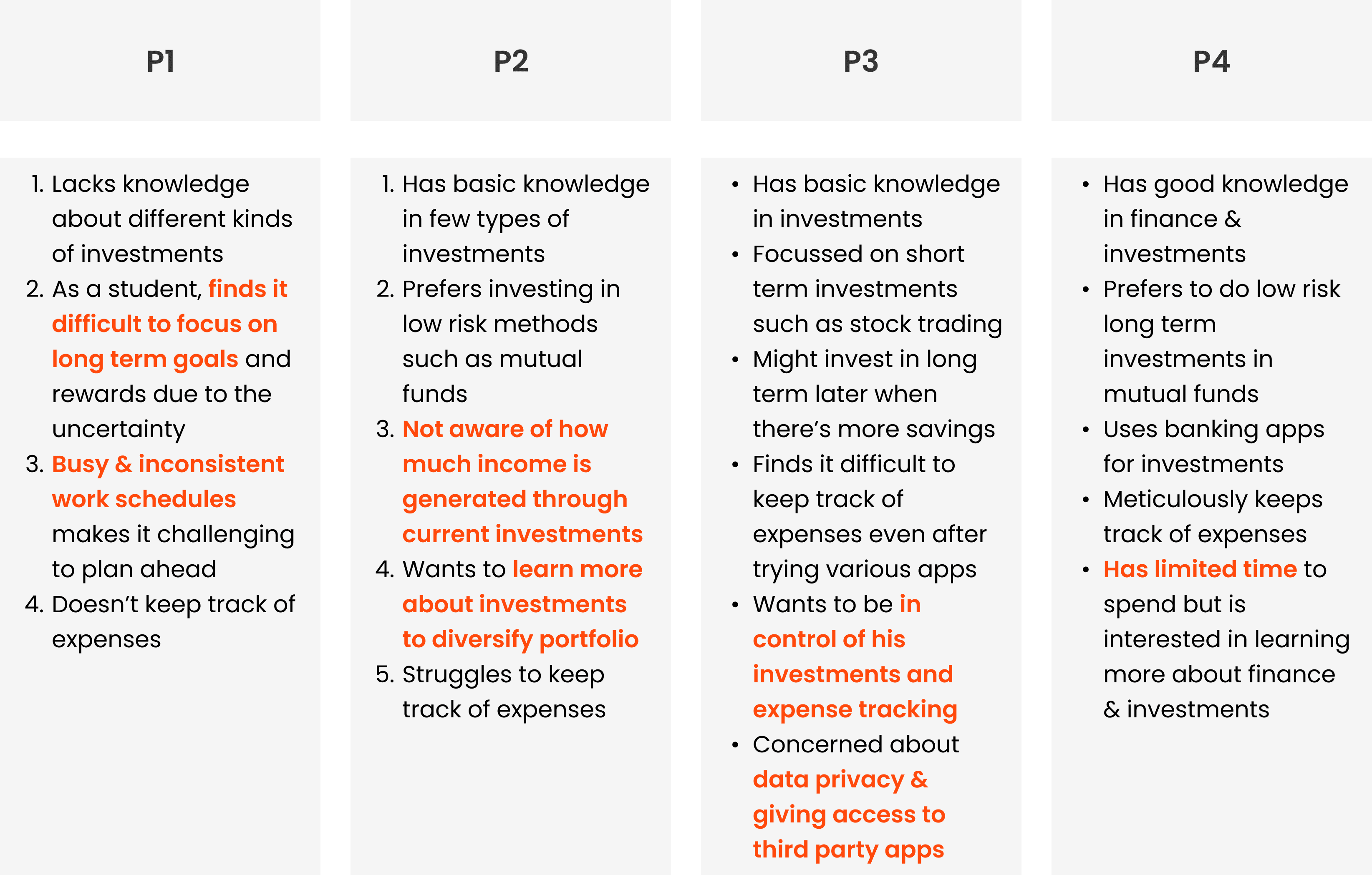

IN-DEPTH USER INTERVIEWS

I conducted online surveys to collect quantitative data on users' financial habits, goals, and preferences. Then I interviewed four potential users to gain a deeper understanding of their experiences and perspectives. I then synthesised the data by creating an affinity map, which helped me identify key findings.

SURVEY RESPONSES

No. of participants: 40

Age range: 18 to 40 years

87.5% of participants use mobile banking

47.5% of participants invest

40% of participants track their expenses

No. of interview participants: 4

KEY QUOTES BY PARTICIPANTS

OBSERVATIONS FROM USER INTERVIEWS

DEFINE

USER PERSONAS

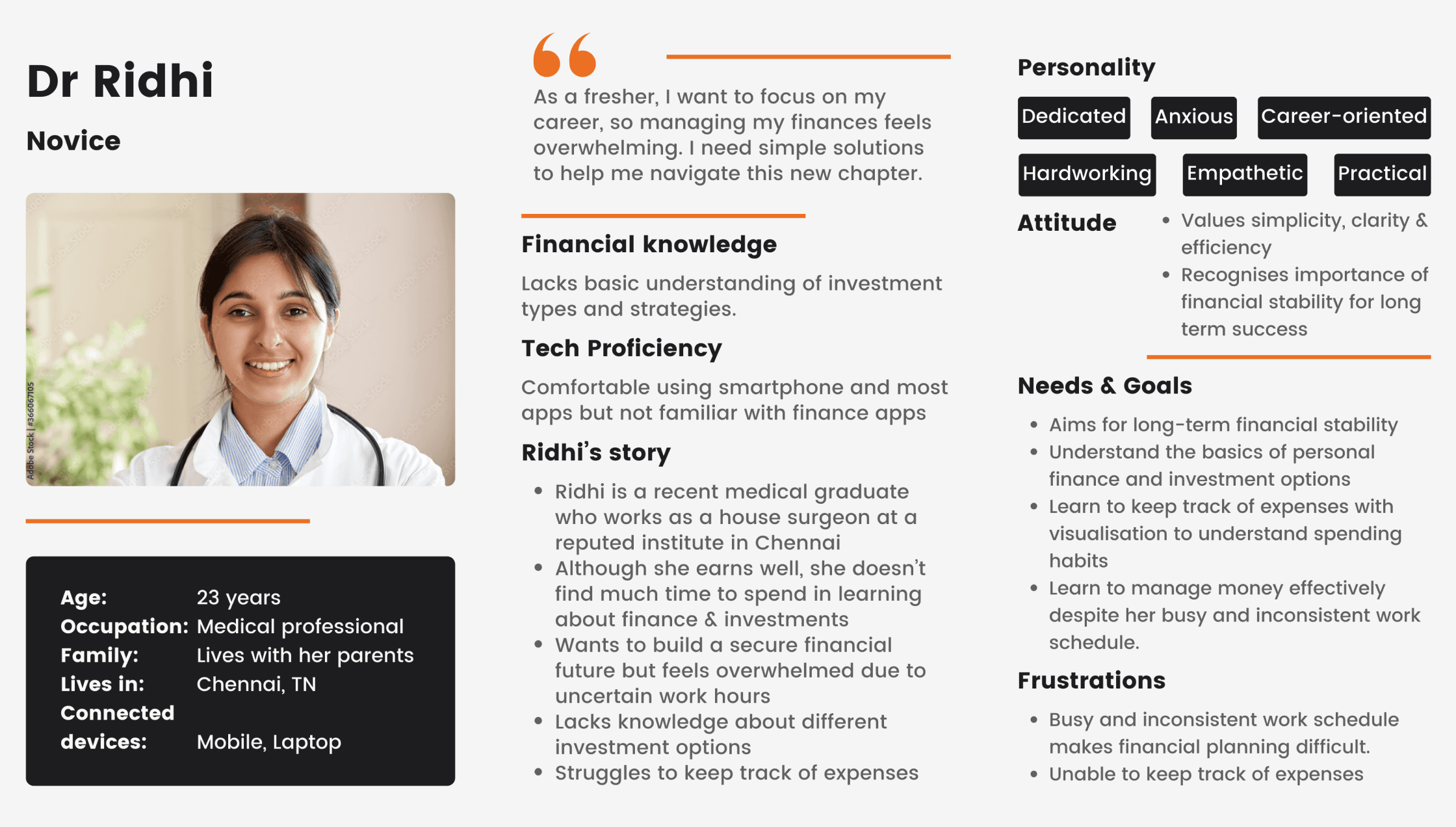

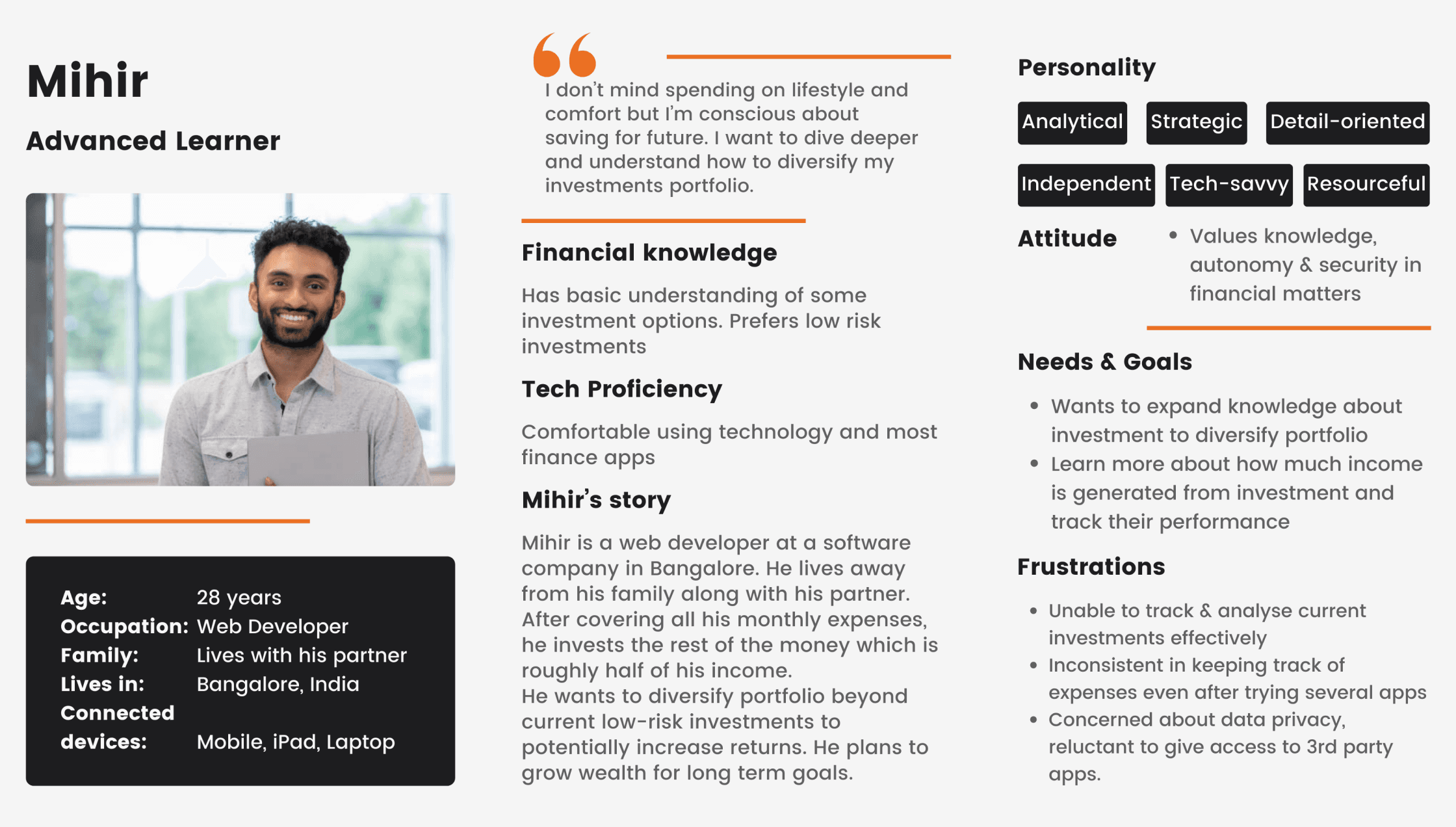

Based on the user interviews conducted, we have identified two distinct persona archetypes:

Novice

Lacks basic understanding of investment types and strategies

Doesn’t track expenses or know how to analyse income and expenses

Advanced learner

Has basic understanding of some investment options

Knows how to track expenses but struggles to do so due to time constraints

KEY INSIGHTS

OPPORTUNITIES

Due to busy work schedules, users find it difficult to take out time to track income & expenses

Novice users don’t utilise their savings for financial growth due to lack of knowledge on finance management & investment types

Users with basic understanding of finance want to learn more about different type of investments & risks involved in order to make better financial decisions

INSIGHTS

Users need effortless, time-saving methods to track expenses and manage finance because of their busy schedule

Beginners lack financial education to explore investment options and confidently manage their finances

Advanced investors need further guidance to diversify their portfolio and make well-informed decisions based on their long term goals

POV STATEMENTS

USER NEEDS

Understand the basics of personal finance and investment options

Learn to manage money effectively despite their busy work schedule

Expand knowledge about investment to diversify portfolio

POV STATEMENTS

A young professional interested in exploring investment opportunities wants to understand the basics of personal finance and investments so that they can manage & utilise their savings for financial growth

An intermediate level investor needs guidance to manage and diversify their portfolio effectively so that they can make well informed decisions and optimise their portfolio to align with their goals

HOW MIGHT WE…

IDEATION

SELECTED IDEAS

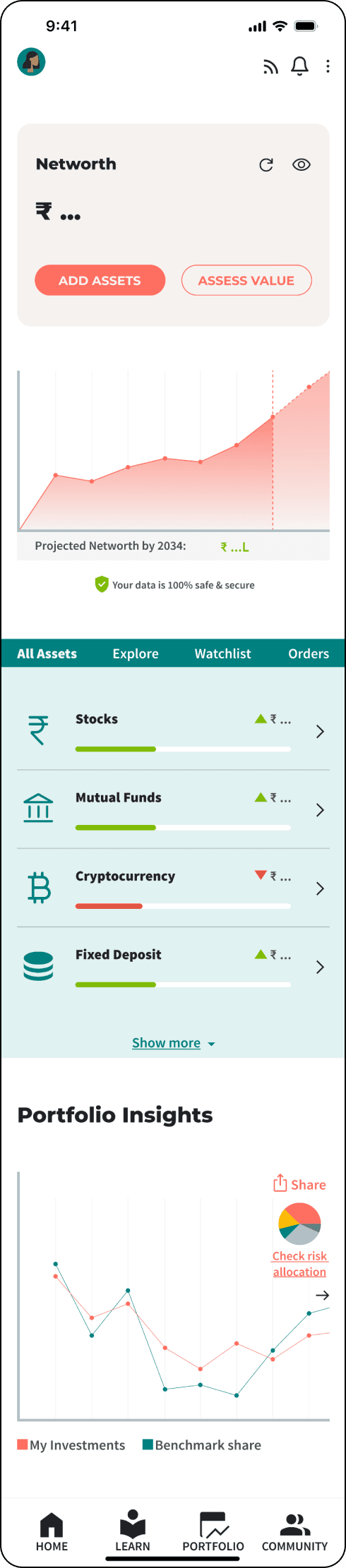

Users can track their investment portfolios in real-time, with AI-powered analysis providing personalised recommendations for optimising portfolio performance.

Users can participate in a peer-to-peer review system where they can share their portfolio, review investment products and services, and seek advice from fellow investors.

Case studies provide valuable insights and inspiration for users looking to learn from the experiences of successful investors.

As a premium service, users can schedule virtual one-on-one sessions with investment experts for personalised guidance, portfolio reviews, and investment strategy consultations.

PROJECT GOALS

FEATURE SET

MUST HAVE

Personal Finance course

Virtual portfolio

Investment portfolio tracking

Goal tracking

AI investment coach

News articles and market insights

NICE TO HAVE

Finance Community

Virtual 1:1 session with Investment experts

Peer to peer review

SUPRISING & DELIGHTFUL

Case study on financial influencers investment strategies

Step-by-step demo on finance skills such as budget worksheet, portfolio rebalancing, etc.

CAN COME LATER

Advanced investment courses

Webinars, workshops and personalised coaching

INFORMATION ARCHITECTURE

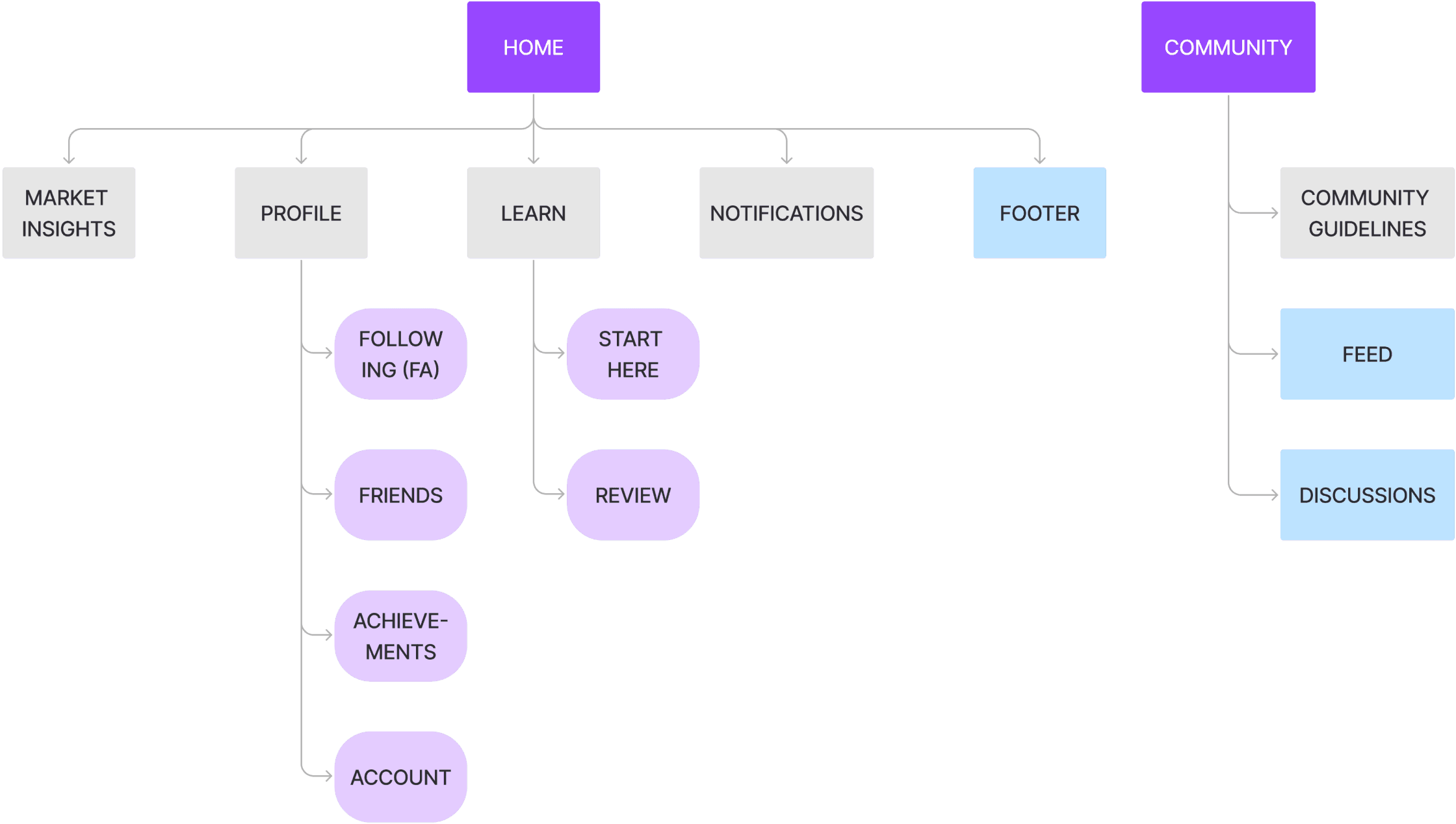

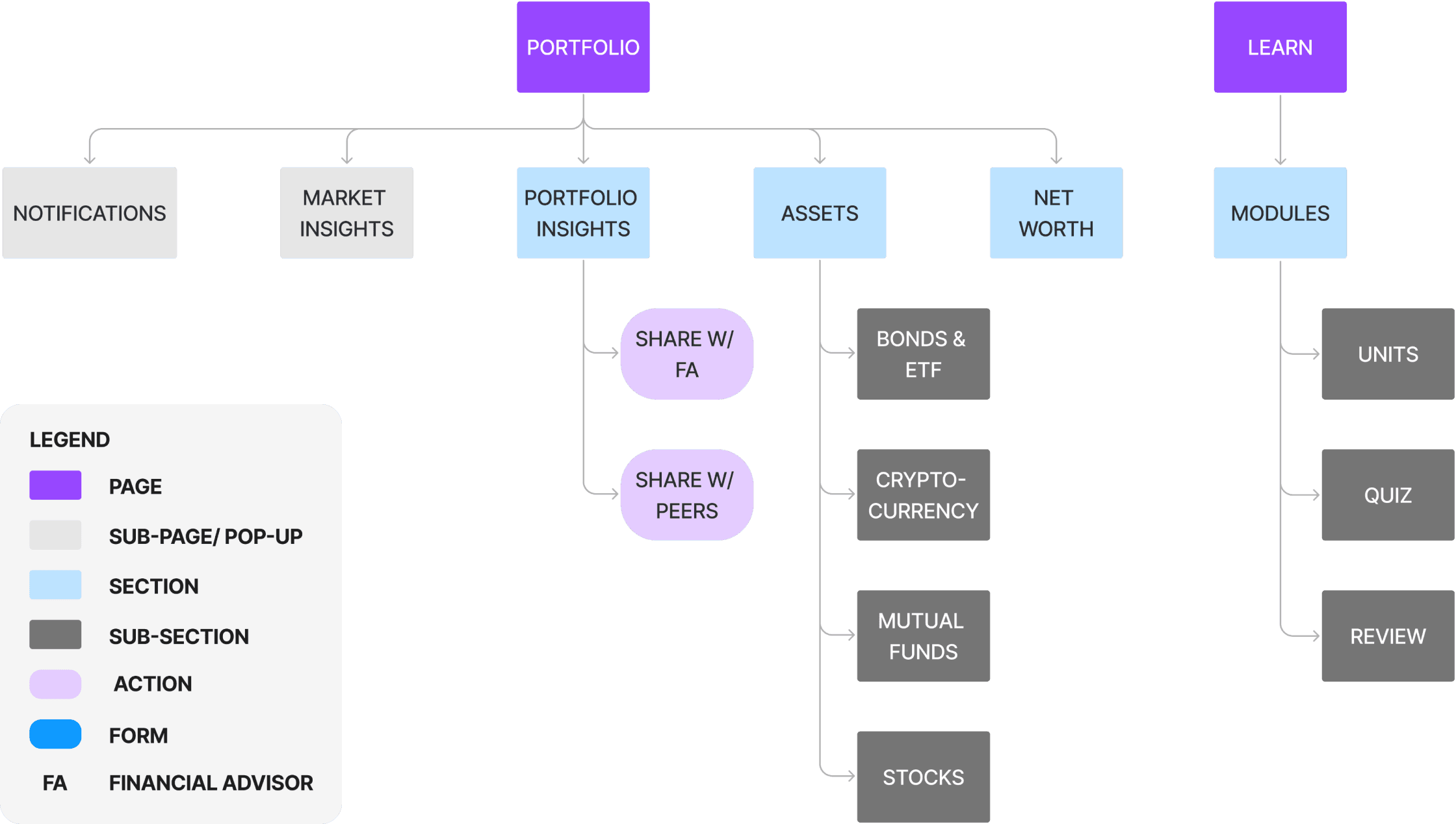

SITEMAP

The sitemap is structured for easy navigation between key features like the Personal Finance course, portfolio and community. It also includes sections for market insights, notifications, and portfolio performance, ensuring users can quickly access the tools and resources they need.

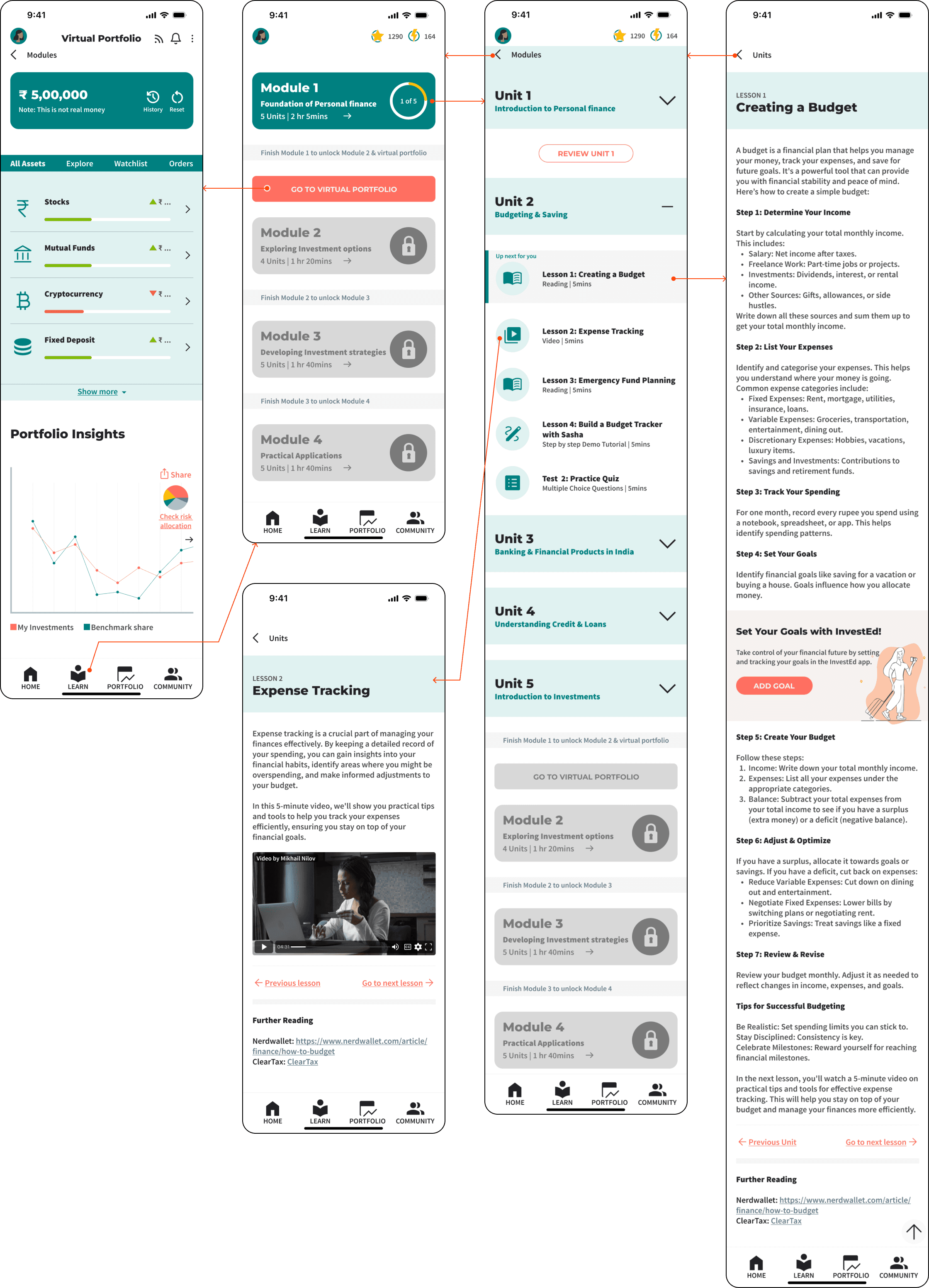

HOME PAGE & COMMUNITY

PORTFOLIO & LEARN PAGE

TASK FLOW

TASK 1: Completing a learning module

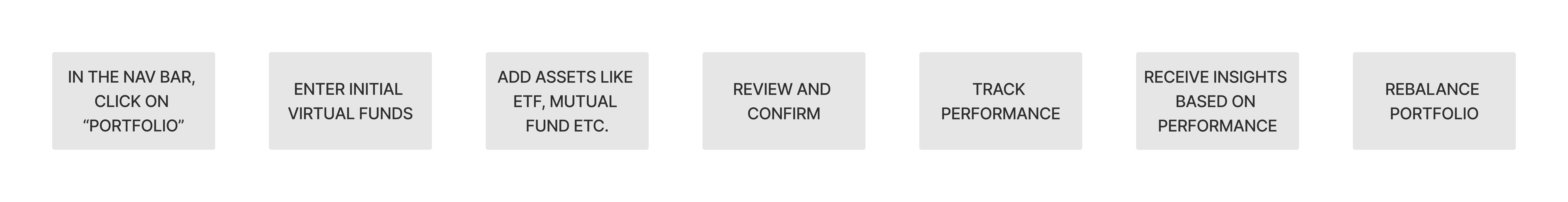

TASK 2: Creating and managing virtual portfolio

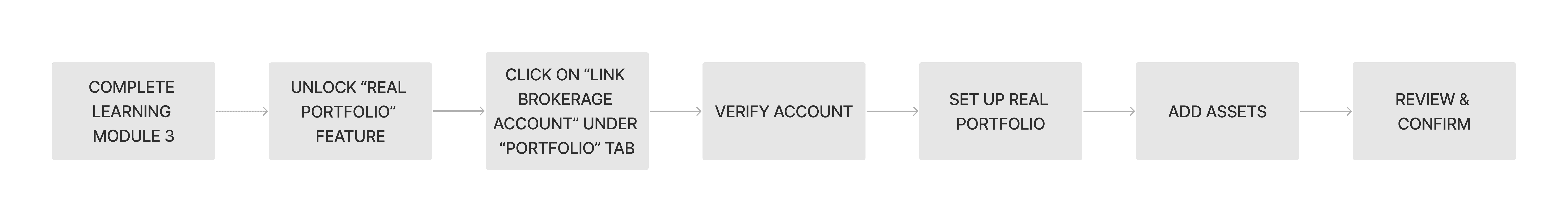

TASK 3: Transitioning to a real portfolio- Setup a real portfolio

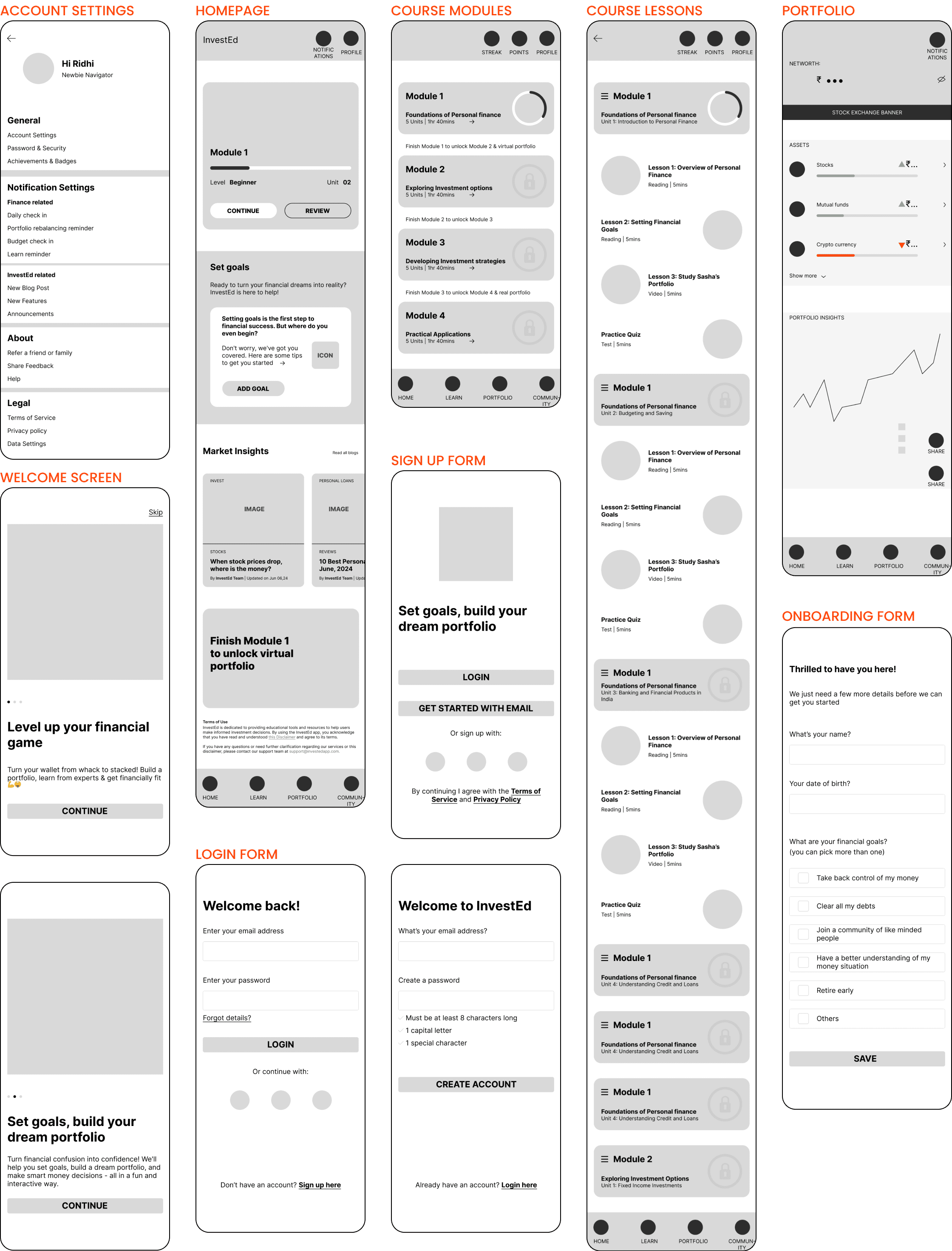

LO-FI WIREFRAMES

The lo-fi wireframes provided a clear, simplified blueprint of the app's layout and user flow. I started with basic pen-and-paper sketches for key features like the Personal Finance course, Virtual Portfolio, and Investment Portfolio. Afterward, I translated these into more detailed scale drawings on Figma. This process helped me identify potential usability issues early, allowing for iterative improvements before progressing to high-fidelity designs.

USER INTERFACE DESIGN

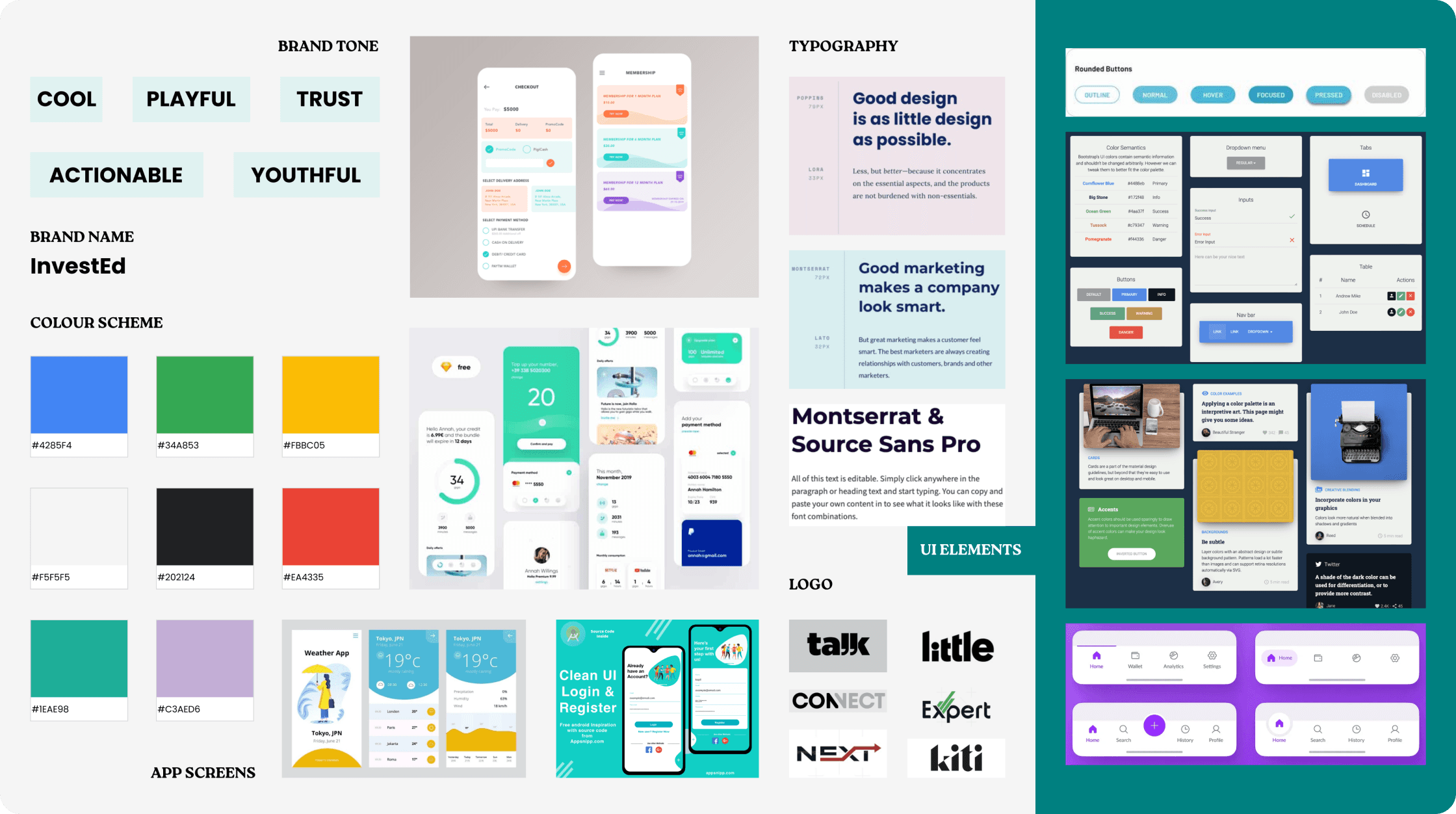

MOODBOARD

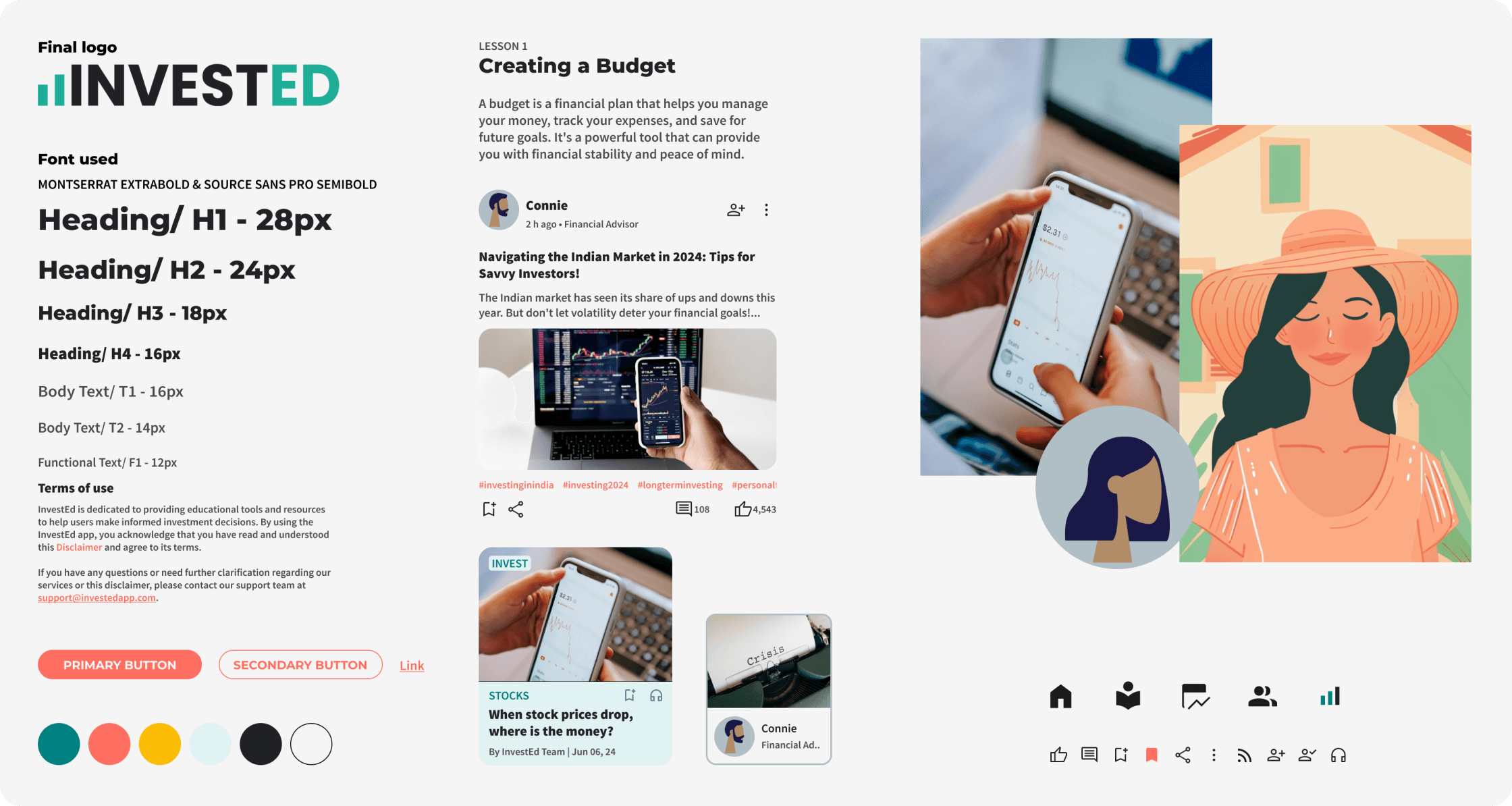

UI KIT & BRAND IDENTITY

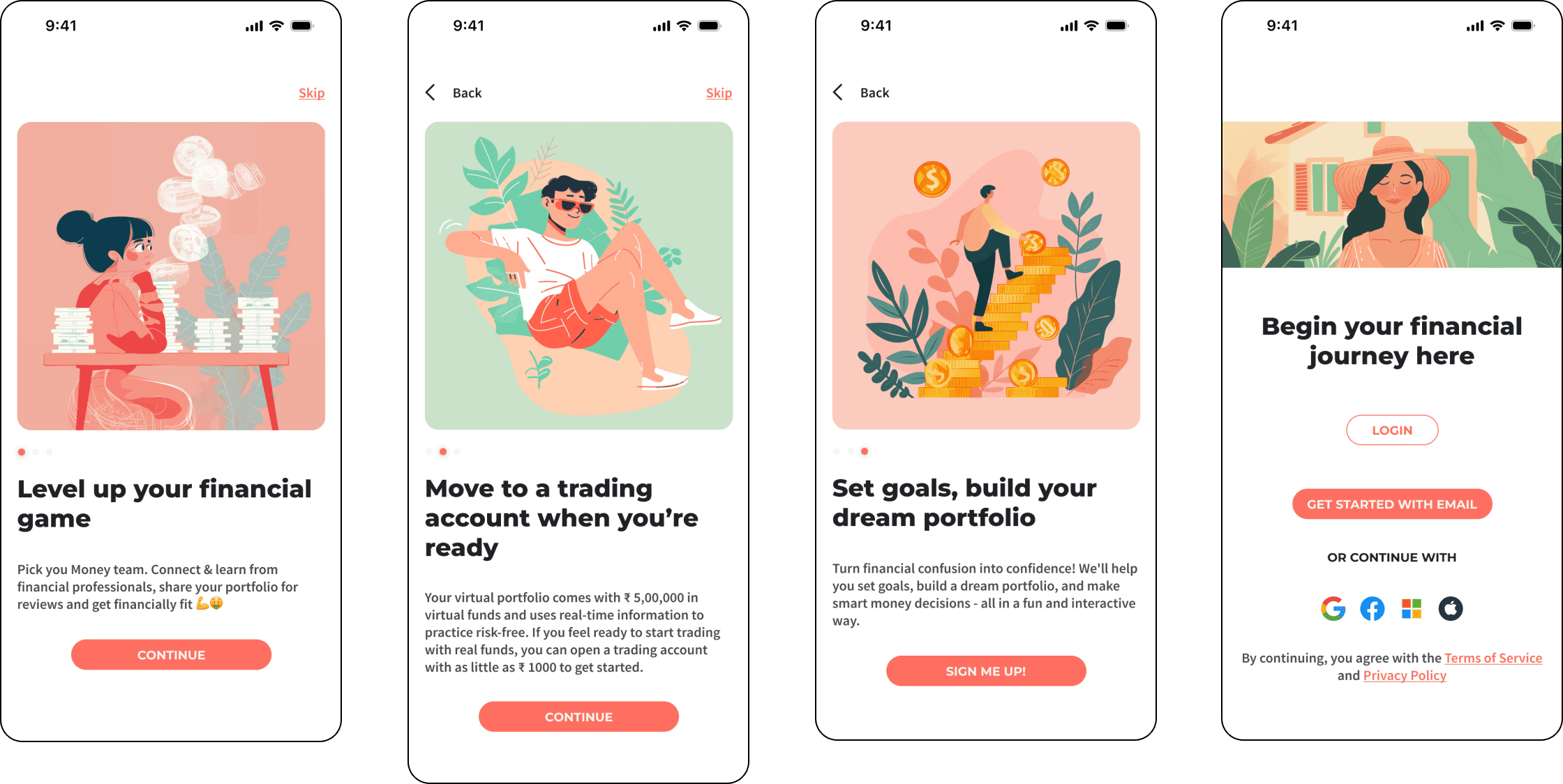

The UI kit for InvestEd reflects the app’s playful yet professional tone, combining clean typography with a vibrant color scheme. I chose Montserrat and Source Sans Pro to give the app a modern, cool vibe, while green and coral accents highlight growth and education. The soft mint and white background colors keep the interface light and approachable. To maintain a youthful feel, I incorporated cute, minimalistic illustrations throughout the app.

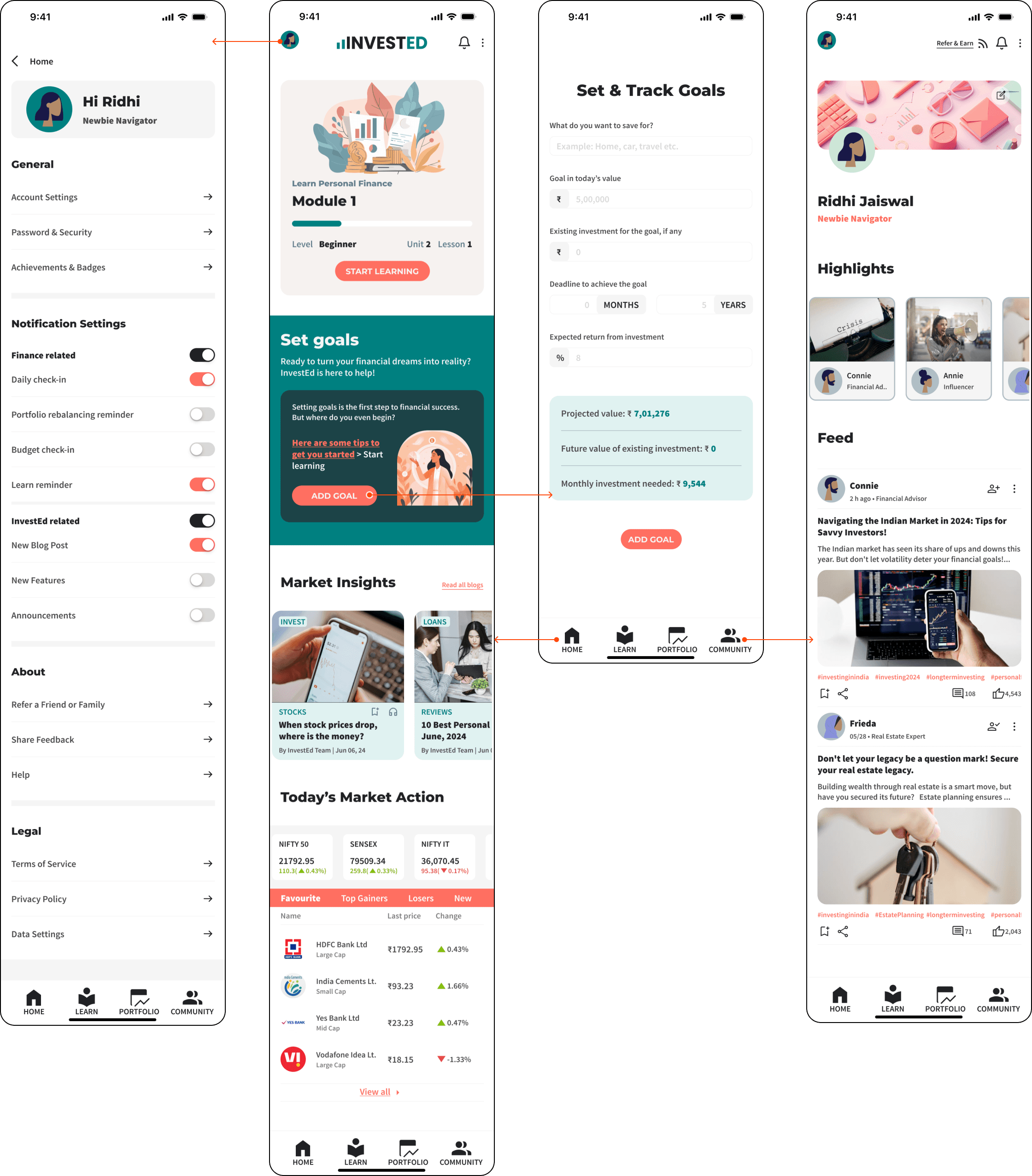

HI-FI WIREFRAMES

HOMEPAGE & COMMUNITY SCREENS

VIRTUAL PORTFOLIO & LEARN

INVESTMENT PORTFOLIO

ACCOUNT CREATION & ONBOARDING FORM

WELCOME SCREENS

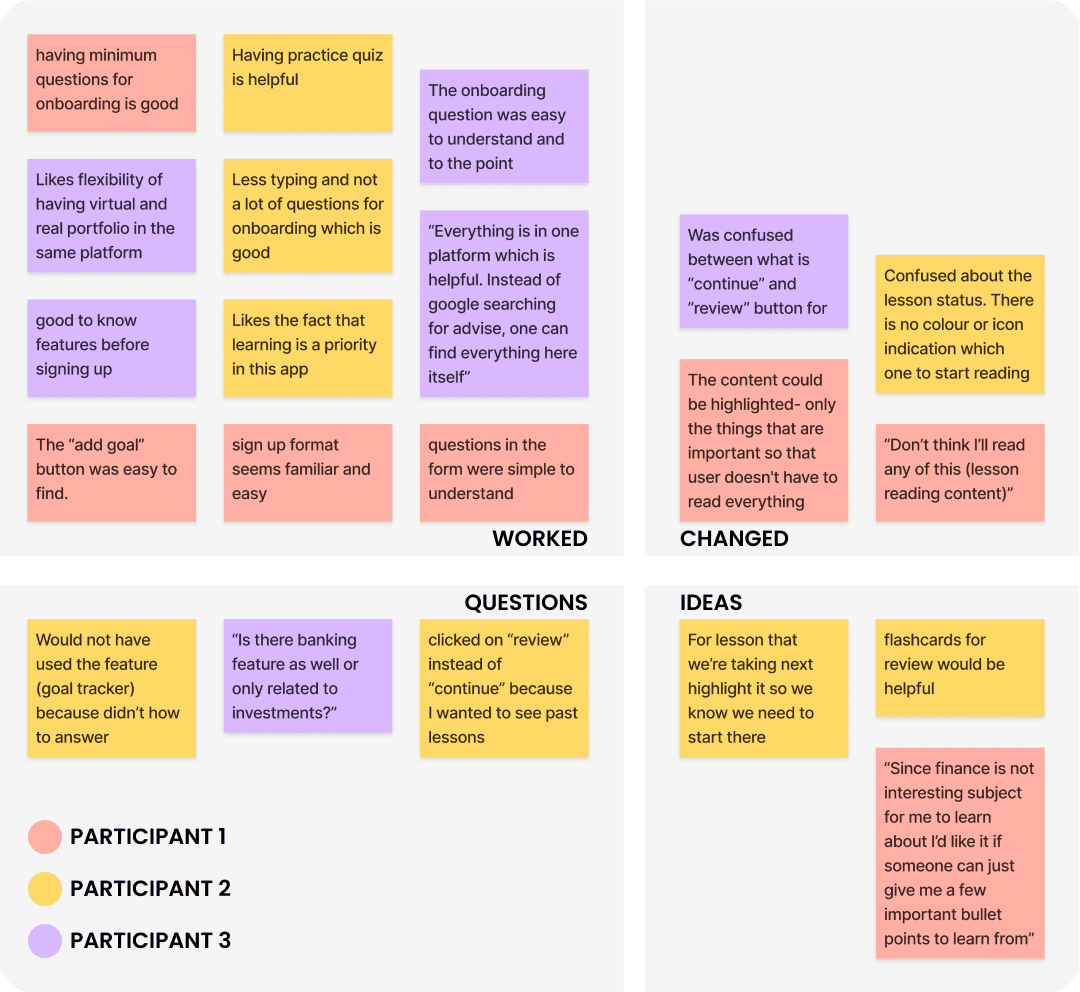

USER TEST

RESEARCH GOAL

To conduct a usability test to understand end users' preferences, with the aim to evaluate how users navigate the app, complete tasks and engage with educational content.

RESEARCH METHOD

Conducted tests remotely using zoom

Used affinity mapping method to identify common themes and recommendations Sorted the feedback using feedback grid

Sorted recommendation through frequency to severity mapping to prioritise results

TASKS

Account creation & Onboarding

Complete a lesson

Add a goal

KEY SESSION TAKEAWAYS

The reading content in the lessons could be highlighted to emphasise only what is important.

In the Learn section of the homepage, CTA button “continue” may not be clearly communicating its purpose

The active lesson colour is close to grey which might confuse some users

Participant 3 did not understand which CTA button is for what in the Learn module section in homepage

FEEDBACK GRID

FINAL ITERATIONS

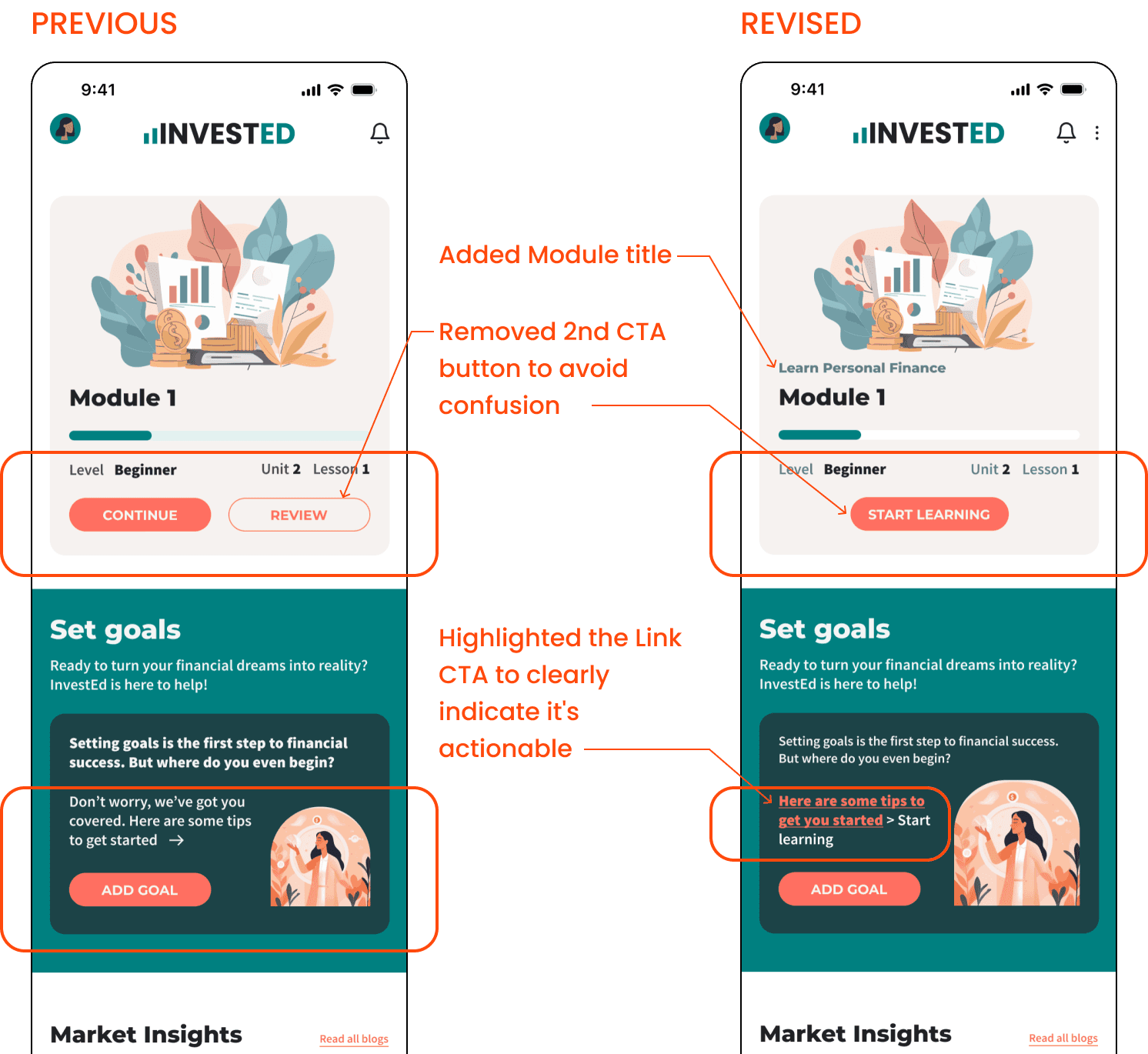

HOMEPAGE

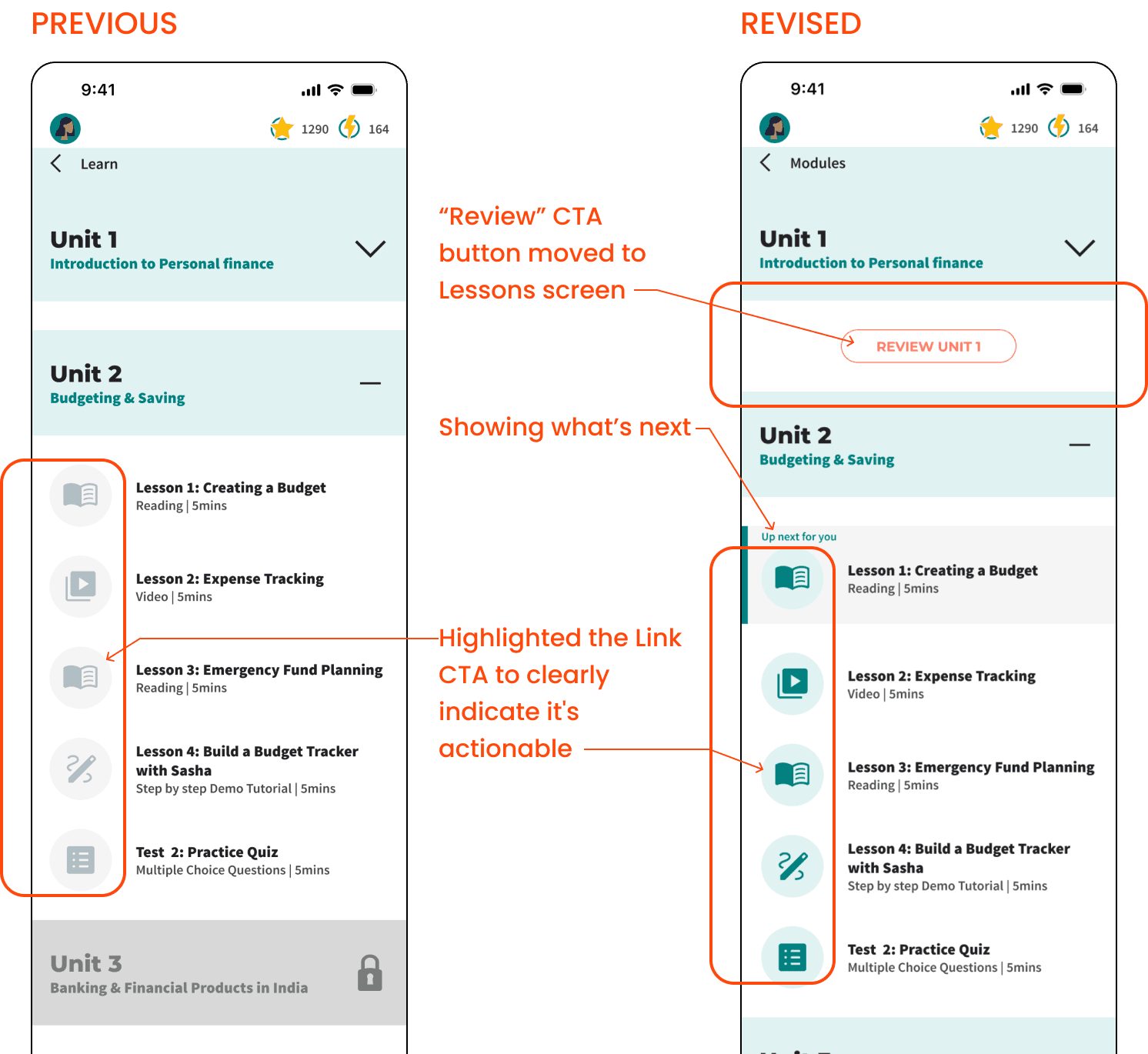

PERSONAL FINANCE COURSE- LESSONS

CASE STUDY KEY INSIGHTS

This project was a bit challenging for me since I knew little about personal finance, especially in the Indian context. But I believe that as a designer, I should be ready to tackle any problem, no matter how unfamiliar. Also, coming in with fresh eyes helped me stay open-minded and unbiased, allowing me to discover new insights along the way.

When I started talking to users, I realised just how varied their experiences with finance were. Some knew nothing about it, while others were deeply involved. This range of perspectives made it clear that the app needed to cater to different levels of knowledge.

My research also highlighted the importance of financial literacy and showed me that sometimes, the simplest tools can be the most effective. This understanding led me to create straightforward how-to guides and step-by-step demos. I also saw the potential to connect beginners with finance experts and influencers, turning the app into a platform that not only educates but also provides support and community. Overall, this project reinforced the idea that listening to users and simplifying complex topics is key to making information accessible to everyone.